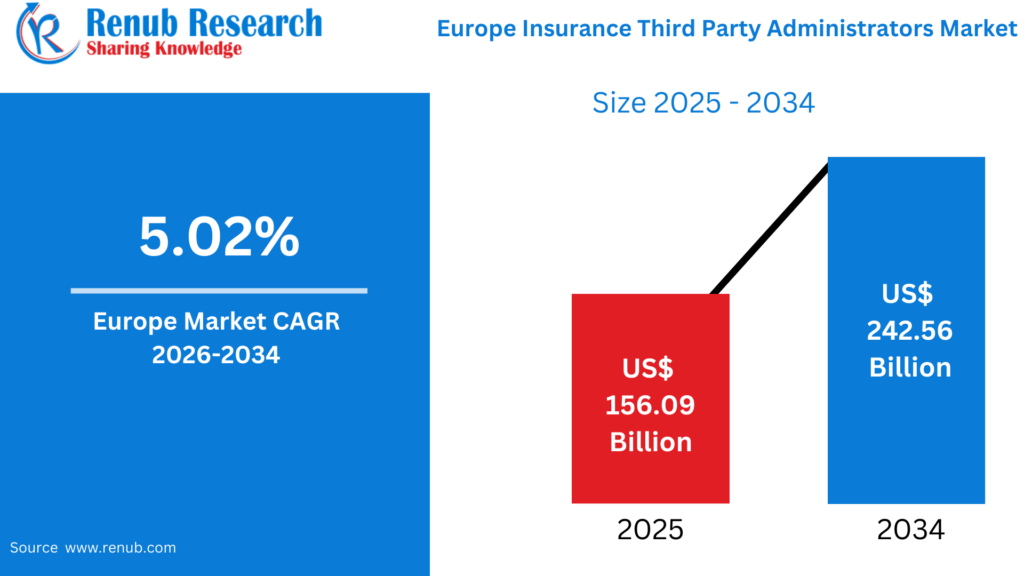

Europe Insurance Third Party Administrators Market Size and Forecast 2026–2034

According to Renub Research Europe Insurance Third Party Administrators (TPA) market is projected to experience steady and sustainable growth over the forecast period. The market size is expected to expand from US$ 156.09 billion in 2025 to approximately US$ 242.56 billion by 2034, registering a compound annual growth rate (CAGR) of 5.02% during 2026–2034. This growth trajectory is underpinned by the increasing outsourcing of claims processing, policy administration, billing, enrollment, and customer support services by insurance companies across Europe.

Insurance carriers are under mounting pressure to improve operational efficiency, reduce costs, comply with evolving regulatory frameworks, and enhance customer experience. Third Party Administrators play a critical role in addressing these challenges by offering scalable, technology-enabled, and compliance-focused administrative services. The increasing penetration of insurance, digital transformation initiatives, adoption of automation and analytics, and the growing complexity of multi-country insurance operations are collectively reinforcing the long-term expansion of the European TPA market.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-insurance-third-party-administrators-market-p.php

Europe Insurance Third Party Administrators Market Outlook

Insurance Third Party Administrators are specialized service providers that manage a range of administrative, operational, and technical functions on behalf of insurers. Their core services typically include claims processing, policy administration, customer support, billing and enrollment, fraud detection assistance, compliance management, and data analytics. By outsourcing these functions to TPAs, insurers can significantly reduce administrative overhead while improving accuracy, speed, and transparency in service delivery.

Across Europe, TPAs have gained prominence as insurers face rising operational complexity due to diversified product portfolios, cross-border insurance programs, and heightened regulatory scrutiny. TPAs leverage digital platforms, workflow automation, artificial intelligence, and cloud-based infrastructure to deliver faster turnaround times and consistent service quality. This allows insurers to focus more on underwriting expertise, risk selection, product innovation, and distribution strategies.

The expansion of health insurance, corporate benefit programs, and international travel insurance has further amplified demand for TPAs with regional expertise and multilingual capabilities. As automation, AI-driven claims assessment, and data-driven decision-making become integral to insurance operations, TPAs are increasingly positioned as strategic partners rather than cost-centric vendors within Europe’s insurance ecosystem.

Growth Drivers of the Europe Insurance Third Party Administrators Market

Increasing Outsourcing by Insurers and Competitive Pressure from Insurtech

One of the primary growth drivers of the European TPA market is the rising inclination of insurers to outsource non-core operations. Traditional insurance carriers are facing intense competition from digital-first insurtech firms that operate with lean cost structures and superior customer experience models. To remain competitive, insurers are increasingly turning to TPAs to streamline operations and improve agility.

Outsourcing claims processing, policy servicing, billing, and customer support enables insurers to reallocate internal resources toward underwriting innovation, risk management, and product differentiation. TPAs offer scalable platforms and domain expertise that would be costly and time-consuming for insurers to develop internally. For legacy insurers in particular, TPAs provide a lower-risk pathway to modernization while maintaining service continuity and regulatory compliance.

Regulatory Complexity and Compliance Expertise

Europe’s insurance landscape is characterized by a dense and evolving regulatory environment at both the European Union and national levels. Regulations covering solvency, data protection, consumer rights, operational resilience, and conduct standards impose significant compliance burdens on insurers. Managing these requirements across multiple jurisdictions is especially challenging for multinational carriers.

TPAs differentiate themselves by offering deep regulatory knowledge, standardized documentation practices, and compliance-ready workflows. They assist insurers in meeting obligations related to GDPR, anti-fraud controls, fair claims handling, and reporting requirements. The introduction of frameworks such as the Digital Operational Resilience Act (DORA) further reinforces the role of TPAs in managing ICT risk and third-party oversight. By leveraging TPA expertise, insurers can mitigate regulatory risk while ensuring consistent operations across borders.

Digital Transformation and Data-Driven Insurance Operations

Digital transformation is a powerful catalyst for the growth of TPAs in Europe. Insurers are under pressure to digitize the entire policy lifecycle, from onboarding and underwriting to claims settlement and renewals. Many TPAs have invested heavily in cloud-native platforms, automation tools, APIs, and advanced analytics to support this transition.

TPAs enable straight-through processing, real-time claims tracking, omnichannel customer engagement, and data-driven performance monitoring. Artificial intelligence is increasingly used for fraud detection, claims triage, and automated decision-making, improving both efficiency and accuracy. By aggregating operational data across multiple clients, TPAs can provide benchmarking insights and continuous process optimization, reinforcing their value proposition to insurers.

Challenges in the Europe Insurance Third Party Administrators Market

Margin Pressure and Intense Price Competition

Despite growing demand, TPAs in Europe face significant margin pressure. Many insurers continue to view TPAs primarily as cost-saving vendors, leading to aggressive pricing negotiations and commoditization of services. Pricing models based on cost-per-transaction or per-policy metrics limit opportunities for premium differentiation.

At the same time, TPAs must continuously invest in technology upgrades, cybersecurity, regulatory compliance, and skilled personnel, increasing fixed costs. Smaller and mid-sized TPAs often struggle to compete with large players that benefit from economies of scale. Revenue concentration risk also arises when TPAs depend heavily on a small number of large insurer clients, making sustainable profitability a key challenge.

Data Security, Trust, and Reputation Risks

TPAs handle highly sensitive personal and financial data, particularly in health, motor, and travel insurance segments. Any data breach, system failure, or non-compliance with GDPR can severely damage both the TPA’s and insurer’s reputation. As a result, insurers are increasingly cautious about outsourcing to vendors with insufficient security controls.

TPAs must invest heavily in encryption, access management, cybersecurity monitoring, and incident response capabilities. They also face scrutiny over the ethical use of data analytics and automation, especially where algorithmic decisions affect claims outcomes or customer experience. Building and maintaining trust with insurers and policyholders remains an ongoing challenge.

Europe Health Insurance Third Party Administrators Market

The health insurance TPA segment is one of the largest and most dynamic in Europe. TPAs manage claims adjudication, provider networks, pre-authorizations, wellness programs, and customer support for health insurers and self-funded employer schemes. Europe’s diverse healthcare systems, ranging from state-led to private insurance-heavy models, create demand for TPAs with strong local market knowledge.

Health TPAs play a critical role in controlling medical costs, detecting fraud and abuse, and negotiating provider tariffs. They also support insurers in launching value-added services such as telemedicine, wellness incentives, and chronic disease management programs. Aging populations and rising healthcare costs are expected to further increase reliance on TPAs for utilization management and member engagement.

Motor Insurance Third Party Administrators Market in Europe

Motor insurance TPAs support insurers with claims handling, roadside assistance coordination, repair network management, and replacement vehicle services. Europe’s high vehicle density, diverse driving conditions, and cross-border travel create complex claims scenarios that require efficient coordination.

TPAs leverage digital first-notice-of-loss systems, photo-based damage assessments, and automated workflows to reduce cycle times and improve customer satisfaction. As telematics and connected vehicles gain adoption, TPAs are increasingly managing data-driven claims and usage-based insurance models, enhancing their strategic importance to motor insurers.

Europe Travel Insurance Third Party Administrators Market

Travel insurance TPAs specialize in emergency assistance, medical repatriation, claims processing, and multilingual customer support. Europe’s position as a major hub for international travel makes TPAs essential for handling cross-border medical emergencies, trip disruptions, and logistical coordination.

Volatility caused by pandemics, geopolitical tensions, and natural disasters has increased the complexity of travel insurance operations. TPAs help insurers adapt quickly by managing spikes in claims volumes, updating policy conditions, and coordinating with global service providers. Their ability to deliver real-time assistance and manage international claims efficiently is critical to travel insurers.

Insurance Third Party Claims Management Market in Europe

Claims management remains the core service offering for most European TPAs. They manage end-to-end claims processes, including notification, investigation, documentation, assessment, and settlement. Effective claims management focuses on reducing cycle times, improving accuracy, and enhancing policyholder experience.

TPAs deploy digital portals, automation, and analytics to prioritize claims, detect fraud, and optimize resource allocation. Claims data generated by TPAs also support insurers in refining underwriting strategies and product design. Given strict service-level agreements, operational excellence is a key differentiator in this segment.

Europe Insurance Third Party Billing and Enrollment Market

Billing and enrollment services are critical for group health, employee benefits, and corporate insurance programs. TPAs manage premium collection, eligibility tracking, policy issuance, and life-event changes while interfacing with payroll and HR systems.

Outsourcing billing and enrollment reduces administrative errors, improves reconciliation, and enhances participant experience. As digital onboarding, e-signatures, and real-time eligibility checks become standard, TPAs compete on portal usability, integration capabilities, and reporting transparency.

Country-Level Market Insights

Germany Insurance Third Party Administrators Market

Germany’s highly regulated insurance environment drives demand for TPAs with strong compliance capabilities and process precision. TPAs support health, motor, and industrial insurance lines while adhering to strict consumer protection standards. Digitalization initiatives such as e-health cards and electronic claims are accelerating TPA adoption.

United Kingdom Insurance Third Party Administrators Market

The UK represents one of Europe’s most mature TPA markets, supported by a sophisticated insurance ecosystem and the presence of Lloyd’s and global carriers. TPAs in the UK emphasize customer experience, innovation, and digital integration, positioning themselves as strategic transformation partners for insurers.

Competitive Landscape

The European Insurance TPA market features a mix of global players and regional specialists competing on technology, regulatory expertise, and service breadth. Prominent companies operating in the market include Charles Taylor Plc., Crawford & Company, ESIS Inc., EXLService Holdings Inc., Gallagher Bassett Services Inc., Helmsman Management Services LLC, Meritain Health, Sedgwick Claims Management Services Ltd, and UnitedHealthcare Services Inc..

Conclusion The Europe Insurance Third Party Administrators market is set for sustained growth through 2034, driven by outsourcing trends, regulatory complexity, and digital transformation. While margin pressure and data security risks pose challenges, TPAs that invest in technology, compliance, and customer-centric service models are well-positioned to capture long-term opportunities. As insurers increasingly seek strategic partners rather than transactional vendors, TPAs will remain integral to the evolution of Europe’s insurance ecosystem.