United States High-Density Polyethylene Market Size & Forecast 2026–2034

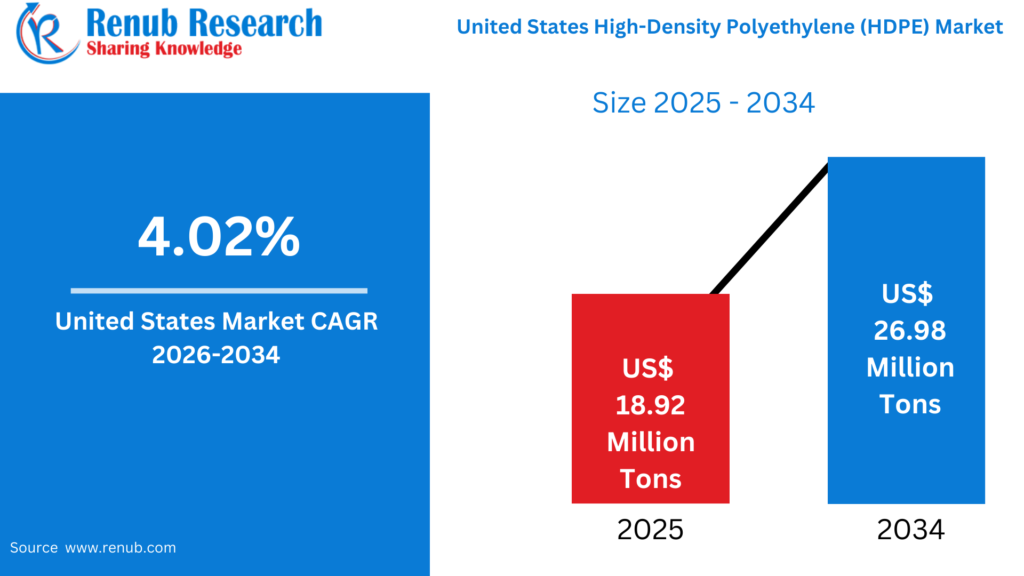

According to Renub Research United States High-Density Polyethylene (HDPE) market is expected to expand steadily over the forecast period, supported by rising demand from packaging, construction, automotive, and infrastructure applications. The market stood at 18.92 million tons in 2025 and is projected to reach 26.98 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.02% during 2026–2034. This growth reflects the increasing preference for lightweight, durable, and recyclable plastic materials, as well as continuous advancements in recycling technologies and sustainable HDPE grades.

HDPE is one of the most widely used thermoplastics in the United States, valued for its versatility, mechanical strength, and chemical resistance. As industries face growing pressure to improve material efficiency, reduce costs, and meet environmental regulations, HDPE continues to gain prominence as a preferred polymer across both consumer and industrial value chains.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=united-states-high-density-polyethylene-hdpe-market-p.php

United States High-Density Polyethylene Market Outlook

High-Density Polyethylene is a petroleum-derived thermoplastic polymer known for its high strength-to-density ratio, excellent moisture resistance, and durability. HDPE is extensively used in the manufacture of bottles, rigid containers, caps and closures, pipes, geomembranes, films, automotive components, and industrial containers. Its lightweight nature, resistance to chemicals and corrosion, and ability to withstand temperature variations make it suitable for demanding applications in packaging and infrastructure.

In the United States, demand for HDPE is strongly influenced by growth in the packaging, construction, and infrastructure sectors. In packaging, HDPE is widely used for food and beverage containers, household chemical bottles, and personal care packaging due to its safety, rigidity, and compatibility with recycling systems. In construction and utilities, HDPE pipes are increasingly replacing traditional materials such as metal and concrete because of their long service life, flexibility, and lower maintenance requirements. Furthermore, HDPE’s recyclability positions it as a key material in circular economy initiatives, reinforcing its importance in the evolving U.S. plastics landscape.

Growth Drivers in the United States High-Density Polyethylene Market

High Demand in Packaging and Consumer Products

Packaging and consumer products represent the largest demand segment for HDPE in the United States. HDPE is extensively used in bottles, containers, drums, caps, and closures for food, beverages, detergents, cosmetics, and household chemicals. The material’s strength, chemical resistance, and food-grade safety make it ideal for protecting contents while maintaining lightweight packaging.

The rapid expansion of packaged food consumption, e-commerce, and home delivery services has significantly increased the need for durable yet lightweight packaging solutions. HDPE enables manufacturers to reduce transportation costs and carbon footprint while ensuring product integrity. Additionally, major consumer goods companies increasingly prefer HDPE due to its high recyclability rate, which aligns with corporate sustainability commitments and regulatory expectations. As consumer awareness of sustainable packaging grows, HDPE’s recyclability advantage continues to strengthen its market position.

Infrastructure Development and Construction Applications

Infrastructure modernization and construction activities are key drivers of HDPE consumption in the United States. HDPE pipes are widely used in water supply, sewage, drainage, and gas distribution systems because of their corrosion resistance, flexibility, and long operational lifespan. Compared with traditional materials, HDPE piping systems offer lower installation costs, reduced leakage, and minimal maintenance requirements.

Government initiatives focused on upgrading aging infrastructure further boost demand for HDPE pipes and fittings. In addition, HDPE geomembranes are used in landfills, wastewater treatment plants, and water management systems for containment and environmental protection. The ability of HDPE to withstand harsh environmental conditions makes it particularly attractive for large-scale infrastructure and civil engineering projects across the country.

Recyclability and Sustainability Initiatives

Sustainability has become a major growth driver for the U.S. HDPE market. HDPE is one of the most commonly recycled plastics, and recycled HDPE (rHDPE) is increasingly used in packaging, automotive parts, and construction materials. Regulatory pressure to reduce plastic waste, combined with corporate commitments to circular economy principles, is accelerating the adoption of recycled content in HDPE products.

Advancements in mechanical and chemical recycling technologies have improved the quality and consistency of rHDPE, enabling its use in higher-value applications. Many brand owners have set targets for incorporating post-consumer recycled HDPE into their packaging, further driving demand. As sustainability regulations tighten and recycling infrastructure improves, HDPE’s recyclability will remain a critical advantage in the U.S. plastics market.

Challenges in the United States High-Density Polyethylene Market

Environmental Concerns and Regulatory Pressure

Despite its recyclability, HDPE faces challenges related to broader environmental concerns surrounding plastic waste. Increasing scrutiny of single-use plastics, especially in packaging, may affect demand in certain applications. Compliance with evolving environmental regulations requires manufacturers to invest in recycling technologies, sustainable product design, and waste management systems, which can increase operational costs.

Public perception of plastics, even recyclable ones, can also influence consumption patterns. While HDPE is often promoted as an environmentally responsible plastic, negative sentiment toward plastic usage may limit growth in specific end-use segments, particularly single-use packaging.

Commodity Price Fluctuations

HDPE production relies on petrochemical feedstocks, making the market sensitive to fluctuations in crude oil and natural gas prices. Volatility in raw material and energy costs can impact production margins and pricing stability. Sudden price changes may affect profitability for manufacturers and create uncertainty for downstream consumers. Managing feedstock price risk remains an ongoing challenge for the U.S. HDPE industry.

United States High-Density Polyethylene Market by Type and Process

United States High-Density Naphtha Polyethylene Market

Naphtha-based HDPE represents a smaller but important segment of the U.S. market. While ethane from shale gas dominates U.S. feedstocks, naphtha-based production remains relevant for specific HDPE grades requiring particular molecular characteristics. Naphtha-based HDPE is used in industrial containers, specialty packaging, and certain automotive components where stiffness, surface finish, and processability are critical. This segment complements ethane-based production by meeting niche performance requirements.

United States High-Density Blow Molding Polyethylene Market

Blow molding is a major processing method for HDPE in the United States, supporting the production of bottles, containers, drums, and jerry cans. Demand is driven by food and beverage packaging, personal care products, household chemicals, and industrial fluids. HDPE’s impact resistance and chemical stability make it ideal for safely storing and transporting liquids. Increasing use of recycled HDPE in blow-molded products further supports sustainability goals while maintaining performance.

United States High-Density Injection Molding Polyethylene Market

Injection-molded HDPE is widely used for caps, closures, crates, pallets, bins, housewares, and automotive components. The injection molding process enables high-precision, large-scale production of complex shapes. HDPE’s toughness, chemical resistance, and recyclability make it suitable for reusable and structural products. Growing demand for reusable packaging and logistics solutions is expected to support continued growth in this segment.

High-Density Polyethylene Solution Process Market

Solution-processed HDPE is used to produce specialized grades with controlled molecular weight and uniform polymer structures. These materials are applied in high-performance pipes, geomembranes, industrial films, and specialty containers requiring enhanced mechanical properties. Although solution processing is more complex and costly than other methods, it delivers consistent quality and superior performance for demanding applications.

State-Wise Market Outlook

California

California represents a significant HDPE market due to strong demand from packaging, consumer goods, and construction sectors. Strict environmental regulations encourage the use of recyclable and post-consumer recycled HDPE. Infrastructure projects, water management systems, and sustainable packaging initiatives further support HDPE consumption across the state.

Texas

Texas is one of the largest HDPE markets in the United States, supported by its robust petrochemical industry and access to feedstocks. Demand is driven by packaging, pipes, industrial containers, automotive components, and agricultural applications. Texas also serves as a major production and distribution hub for HDPE due to its logistics and export capabilities.

New York

In New York, HDPE demand is driven by packaging for consumer goods, personal care products, and food items. Infrastructure maintenance and environmental programs promoting recycled materials support HDPE usage in piping systems and packaging. Growth in e-commerce further increases demand for lightweight and durable packaging solutions.

Washington

Washington’s HDPE market benefits from strong environmental awareness and advanced recycling programs. HDPE is widely used in packaging, construction, and infrastructure, particularly for water management and environmental protection applications. Sustainable practices and urban development support stable HDPE demand in the state.

Market Segmentation

Feedstock:

Naphtha, Natural Gas, Others

Application:

Blow Molding, Film and Sheet, Injection Molding, Pipe and Extrusion, Others

Manufacturing Process:

Gas Phase Process, Slurry Process, Solution Process

Top States:

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, and Rest of the United States

Competitive Landscape and Company Analysis

The U.S. HDPE market is competitive, with major global and regional producers focusing on capacity expansion, recycling innovation, and product differentiation. Key companies operating in the market include The Dow Chemical Company, Exxon Mobil Corporation, LyondellBasell Industries N.V., INEOS AG, PetroChina Company Ltd., Braskem SA, Formosa Plastics Corporation, Daelim Co. Ltd., and Dynalab Corp.. These players compete on cost efficiency, product quality, sustainability initiatives, and supply reliability.

Conclusion

The United States High-Density Polyethylene market is set to experience steady growth through 2034, driven by strong demand from packaging, infrastructure, and consumer goods sectors, along with rising emphasis on recyclability and sustainability. While environmental concerns and feedstock price volatility pose challenges, advancements in recycling technologies and growing adoption of circular economy practices continue to strengthen HDPE’s market position. As industries seek lightweight, durable, and cost-effective materials, HDPE will remain a cornerstone polymer in the U.S. plastics industry.