First of all—congratulations. If you are the lucky one who said “yes,” or maybe you’re planning to say “yes” on Valentine’s Day (or you’re planning to propose), we definitely understand your emotions. You are someone right now, high on emotions and floating in the seventh heaven. In addition to this, there may be several other distractions that have captured your attention, such as celebration photos, family calls, or admiring your ring every five minutes.

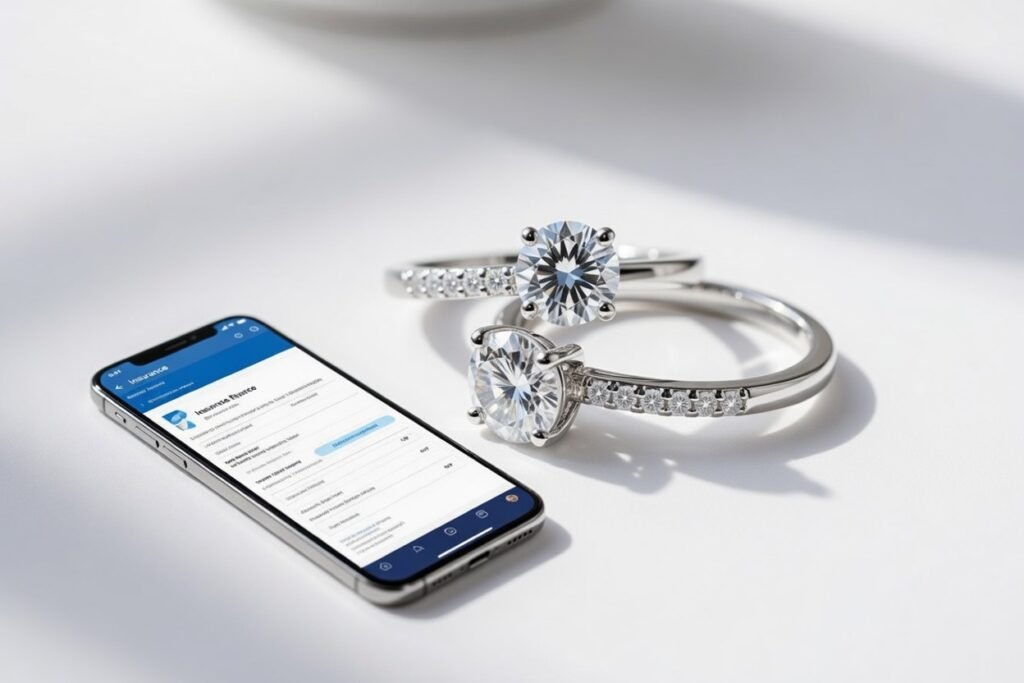

However, in the midst of these celebratory moments, you may overlook several important aspects, including a crucial question that couples often discover later in life. That question is, are you sure your engagement ring is properly insured?

It is totally understandable that the Valentine’s Day proposals are romantic, unforgettable, and meaningful. But once the excitement settles, protecting that ring should be one of your first practical steps. Now, let’s go over the steps to take to ensure the ring is insured. But before getting along with all this information, let’s first understand why, after all, the immediate insurance is required.

Why Valentine’s Day Engagement Rings Need Immediate Insurance

When discussing rings, it’s important to note that most engagement rings do not fall under the heavy jewelry category; instead, they are typically worn daily. You’d want to wear it every day, but something that is worn daily and is expensive is also prone to several unwanted situations, like

- Accidental loss

- Damage

- Theft

- Stone loosening or falling out

When it comes to jewelry valuation, there are several things that you must pay attention to, and the most important one among them that most newly engaged couples have no idea about is that your standard homeowners’ or renters’ insurance policy usually does not fully cover high-value jewelry unless it’s specifically scheduled with a proper valuation.

So, if you are someone wanting a clear answer regarding the question “Do I need an appraisal to insure my engagement ring?” then a clear and direct answer to this question is “Yes.”

Step 1: Get a Professional Jewelry Valuation

As soon as you go to your insurance company to add the ring coverage, they will primarily demand a valuation document. This document is essentially required, as it has several details like

- The ring’s detailed description

- Diamond or gemstone grading

- Metal type and purity

- Measurements and specifications

- Current replacement value

To complete this process, you must visit a professional valuation agency that will conduct the valuation thoroughly, resulting in a document that will be widely accepted. When you go to a valuation agency, they provide you with an official, insurance-ready document stating what it would cost to replace your ring at today’s market prices—not what was paid originally.

This info is important because the value of precious metals and gemstones changes daily, so having a detailed understanding of every aspect of the jewelry is crucial.

Step 2: Choose the Right Insurance Option

Once you have the valuation report from an authorized valuation agency, you need to add a rider to your homeowners or renters insurance policy. Getting this done will provide you with the following benefits, and all they need is the valuation documentation.

- Lower cost

- Covers specific listed jewelry

Ask your insurer:

- Does it cover accidental loss?

- Are there deductibles?

- Is coverage based on agreed value?

If you have the valuation done by a trustworthy valuation agency that has mentioned all the details in the documentation, the process of getting the insurance becomes effortless.

The Growing Trend: Online Jewelry Valuation

If you are someone planning an engagement or a wedding, we understand it’s tough for you. How many things can a person manage, and that too all in- person? Therefore, wherever possible, people love to go for the online options. The same is true with jewelry valuation, too. Many trustworthy companies offer online jewelry valuation services, which are widely considered by couples these days due to their high success rate and authenticity.

Here’s how it typically works:

- Upload clear images of your engagement ring.

- Submit any available documentation (like grading reports).

- Select your turnaround option

- Receive a professional valuation report digitally

Summing Up

Planning well in advance leads to the best decisions. If you are planning to get engaged on Valentine’s Day or someone recently engaged, make sure that you get your ring insured and valued at the earliest to safeguard it from any kind of unnecessary problems.