In today’s fast-paced financial industry, efficiency and accuracy are critical for any lending institution. Whether it’s a bank, credit union, or online lender, managing loan applications manually can be time-consuming, prone to errors, and frustrating for customers. This is where loan origination system software comes into play. It is designed to automate and streamline the entire lending process, from application submission to loan disbursement.

What is a Loan Origination System (LOS)?

A loan origination system (LOS) is specialized software that assists financial institutions in managing the full lifecycle of a loan. The system handles every step, including:

- Loan application intake

- Credit assessment and risk evaluation

- Verification of borrower information

- Document management

- Approval workflows

- Fund disbursement

By centralizing these tasks, LOS software reduces manual effort, ensures compliance with regulations, and provides a better customer experience.

Key Features of Loan Origination System Software

Modern LOS software offers a wide range of features that help lenders work smarter and faster. Some of the most important features include:

1. Automated Loan Processing

Automation is at the heart of loan origination systems. The software can automatically process applications, calculate interest rates, and perform eligibility checks. This reduces errors and speeds up the approval process, helping lenders serve more customers in less time.

2. Document Management

Handling loan documents manually can be messy and risky. LOS software provides secure storage and easy retrieval of all loan-related documents, including ID proofs, income statements, and credit reports. This ensures compliance and reduces the risk of missing or misplaced documents.

3. Risk Assessment and Credit Scoring

Evaluating borrower risk is critical for lending. Loan origination software integrates with credit bureaus and financial databases to perform credit scoring and risk assessments automatically. This enables lenders to make informed decisions quickly.

4. Compliance Management

Financial institutions must comply with strict regulations. LOS software helps maintain compliance by tracking necessary documents, approvals, and audit trails. This minimizes the risk of regulatory penalties and simplifies reporting.

5. Multi-Channel Support

Many lenders now offer multiple ways for borrowers to apply for loans, including web portals, mobile apps, and in-branch applications. Loan origination system software supports multi-channel application processing, ensuring consistency and efficiency across all channels.

6. Customizable Workflows

Different lenders have different processes. Modern LOS solutions allow customization of approval workflows, notifications, and reporting. This flexibility ensures that the software adapts to the institution’s unique requirements.

Benefits of Using Loan Origination System Software

Adopting a robust LOS solution brings numerous advantages for lenders:

- Faster Processing Times: Automation reduces manual tasks, allowing loans to be processed quickly.

- Reduced Errors: Automated checks and validations minimize the risk of mistakes.

- Improved Customer Experience: Borrowers can track their applications online, submit documents digitally, and receive faster approvals.

- Enhanced Data Security: Sensitive borrower information is encrypted and securely stored.

- Better Compliance: Automatic tracking and reporting help meet regulatory standards.

- Scalability: LOS software can handle increasing volumes of loan applications as a business grows.

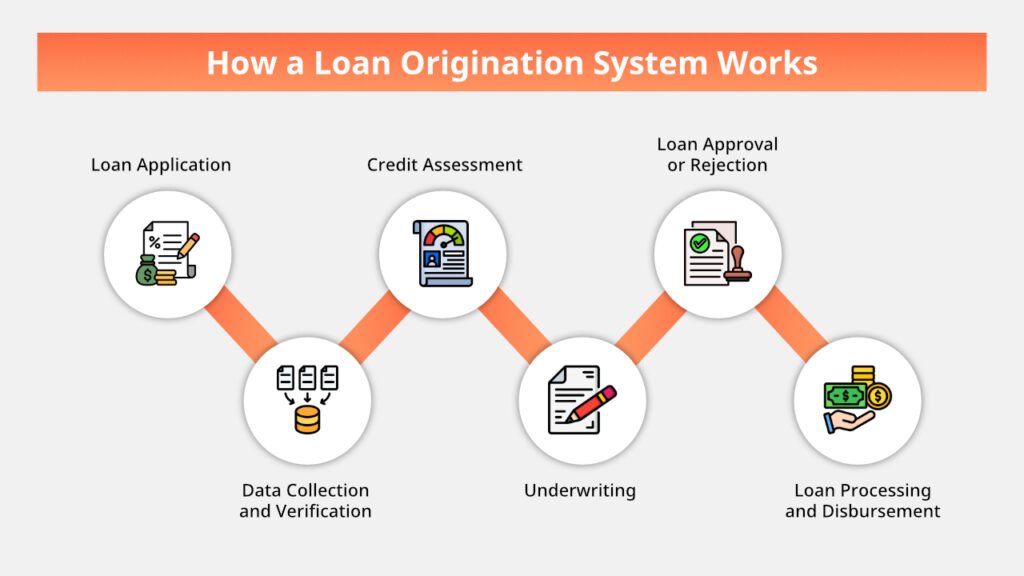

How Loan Origination System Software Works

A typical LOS workflow involves several steps:

- Application Submission: Borrowers submit their loan applications online, via mobile apps, or in-branch.

- Data Validation: The system checks for completeness and verifies borrower details.

- Credit Evaluation: Integration with credit bureaus allows instant credit scoring and risk assessment.

- Approval Workflow: Applications are routed to the appropriate officers based on pre-defined rules.

- Document Verification: Required documents are uploaded, verified, and stored securely.

- Disbursement: Once approved, funds are disbursed, and the loan status is updated in real-time.

This seamless workflow ensures minimal delays, reduced paperwork, and higher customer satisfaction.

Choosing the Right Loan Origination System

Selecting the right LOS software is crucial for any financial institution. Here are some key factors to consider:

- Integration Capabilities: Ensure the software can integrate with existing banking systems and third-party services.

- Ease of Use: User-friendly interfaces for both staff and borrowers are essential.

- Security: Look for features like data encryption, secure access controls, and regular audits.

- Scalability: The software should be able to handle growth in loan applications without performance issues.

- Vendor Support: Choose a provider that offers training, technical support, and regular updates.

The Future of Loan Origination Systems

As technology advances, loan origination system software is becoming even smarter. Artificial intelligence (AI) and machine learning are being incorporated to predict borrower behavior, automate decision-making, and detect potential fraud. Additionally, cloud-based LOS solutions enable remote access, improve collaboration, and reduce costs for financial institutions.

Conclusion

In an industry where speed, accuracy, and compliance are paramount, loan origination system software is a game-changer. It simplifies loan processing, enhances customer experience, and reduces operational risks for lenders. By automating workflows, managing documents, and providing actionable insights, LOS solutions allow financial institutions to focus on growth and customer satisfaction.

If you are looking to modernize your lending operations and stay ahead in the competitive financial market, investing in a reliable loan origination system software is the way forward.

For leading-edge LOS solutions, you can trust FICS to provide software that scales with your lending needs and is secure.