Many credit teams deal with long review cycles, scattered files, and statements that never look the same twice. The pressure to move faster keeps rising, yet manual spreading slows everything down. That is why so many firms are taking a closer look at how technology can support their work.

In this blog, we will talk about what actually matters when you compare spreading tools. You will see which features shape daily tasks, where time savings come from, and how teams gain more confidence in the numbers they use.

What to Look for in Financial Spreading Automation Tools

Below, we have a focused set of elements that shape how useful a spreading tool becomes. Below are some points that help you understand what strong financial spreading automation actually looks like.

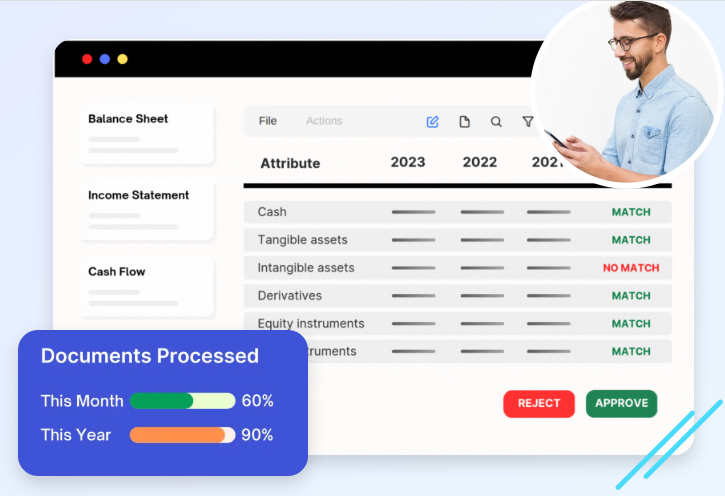

Accuracy and Standardization at Scale

The client often works with large batches of statements from different industries. Each file shows its own structure, so manual spreading rarely produces the same format twice. This is where financial spreading automation starts to matter. A solid tool brings consistency to formulas, line items, and mapping rules. You get spreads that follow a clear logic instead of shifting based on who handled the file.

Accuracy shapes everything that follows in the credit process. Ratios look cleaner when your base numbers follow a stable pattern. Trend reviews feel easier when every period uses the same structure.

When spreads stay aligned, the team does less backtracking and fewer corrections. Even auditors move faster because they do not have to sort through mixed versions of the same borrower’s history.

Standardization also helps new analysts get up to speed. They spend less time copying formats and more time reading the financial story. The client’s team notices this in training cycles, where new hires settle in faster since the templates stay the same across borrowers.

Flexible Data Intake and File Handling

Most lenders deal with all kinds of documents. Some clients send clean Excel files, while others only provide scanned PDFs or year-end statements from small accounting systems. When a spreading tool accepts all of them, you avoid long preparation steps. You upload the files and move forward instead of reorganizing each statement before it becomes useful.

In practice, you often receive partial statements, missing schedules, or mismatched formats. A flexible system handles those variations without slowing the team down. It becomes easier to pull statements from different sources and spread them in one place. This cuts down the time you usually spend opening, rearranging, and comparing layouts.

The client benefits from this when they handle portfolio-wide updates. They spread dozens of files from different business types, and flexible intake keeps the process steady. You get movement instead of interruptions caused by layout problems.

Configurable Outputs and Analytical Features

Each lending team has its own credit models and reporting style. You might use specific ratios or cash-flow views that differ from those of another group. A strong tool respects those differences. You need outputs you can edit, adjust, and align with your lending policy.

Custom formats make reviews smoother. The credit memo looks the way your leadership likes it. The spread feeds directly into your internal scorecards. You do not spend time reformatting numbers after the system produces them. This small shift matters because it keeps your workflow tight and reduces manual handoffs.

Better analytical features help you see patterns faster. You can compare periods without switching between screens. You catch unusual movements without rebuilding formulas. Over time, this gives your team more clarity and fewer distractions.

How These Features Change Day-to-Day Workflows

Below, we have a look at how the right capabilities affect daily tasks. Below are some insights on how analyst time, review quality, and team communication shift once stronger systems are in place.

Faster Reviews Without Cutting Corners

When spreading tools handle the repetitive parts of the job, the review cycle moves faster. You spend less time fixing layouts, adjusting columns, or chasing broken formulas. The early stages feel lighter because you start with a clean file instead of sorting through clutter.

The client sees this during heavy periods. Their analysts manage larger volumes with fewer delays since they no longer lose time to formatting issues. That extra space helps them focus on trend checks, variance explanations, and borrower discussions, the parts of the work that rely on judgment rather than mechanics.

Fewer Errors and Smoother Internal Collaboration

Manual spreading leaves room for small mistakes that can affect the entire review. Automation reduces this risk because the structure stays stable. You spend less time tracking down mismatched numbers and more time studying the results.

This steadiness supports the whole team. Managers read spreads faster, underwriters trust the figures, and committee reviews face fewer adjustments. The client experiences fewer back-and-forth questions because everyone works from outputs that follow the same pattern.

More Time for Deeper Borrower Understanding

With less manual cleanup, you gain more time to study patterns and seasonal changes. The client’s analysts often say they connect better with the financial story when formatting no longer distracts them. This leads to stronger conversations and clearer internal discussions because the spread becomes a tool for insight instead of a task that slows them down.

Conclusion

The need for sharper, faster credit work keeps rising. Teams that choose tools built for accuracy, steady data intake, and flexible outputs gain a clearer path through their daily tasks. These tools change how analysts spend their time and how decisions take shape.

As lending grows more data-heavy, systems built with strong financial spreading automation will help teams move with more confidence and less clutter. The firms that adopt thoughtful tools now set themselves up for a future where speed and sound judgment can work side by side.