Is your charity ready for a rainy day? I mean, really ready? It’s a question that keeps many trustees up at night. Building a financial cushion, or what we call a reserve, can feel like a tricky balancing act. You want to spend donor money on your amazing mission, but you also need to ensure your organisation can weather any storm.

This guide is here to help you navigate the world of charity reserve policies. We’ll break down what they are, why they’re so important for financial resilience, and how you can create a policy that’s perfect for your charity. Let’s get you on the path to financial stability!

Understanding Charity Reserves

First things first, what exactly are we talking about when we say “reserves”? It’s a term that gets thrown around a lot, but what does it actually mean for your charity?

A charity’s reserves are the part of its unrestricted funds that are freely available to spend on any of its purposes. Think of it as your charity’s savings account, set aside for unexpected events, planned projects, or to manage gaps in cash flow. It’s your financial safety net!

Types of Reserves

It’s super important to know the difference between your pots of money:

- Unrestricted Funds: This is money that can be used for any of your charity’s purposes. It’s the most flexible cash you have. Your main reserves are part of this.

- Designated Funds: These are still unrestricted funds, but your trustees have earmarked them for a specific future project, like buying a new minibus or upgrading your IT systems.

- Restricted Funds: This money has been given to your charity for a very specific purpose and cannot be used for anything else. For example, a grant to run a specific youth programme. This money can never be part of your general reserves.

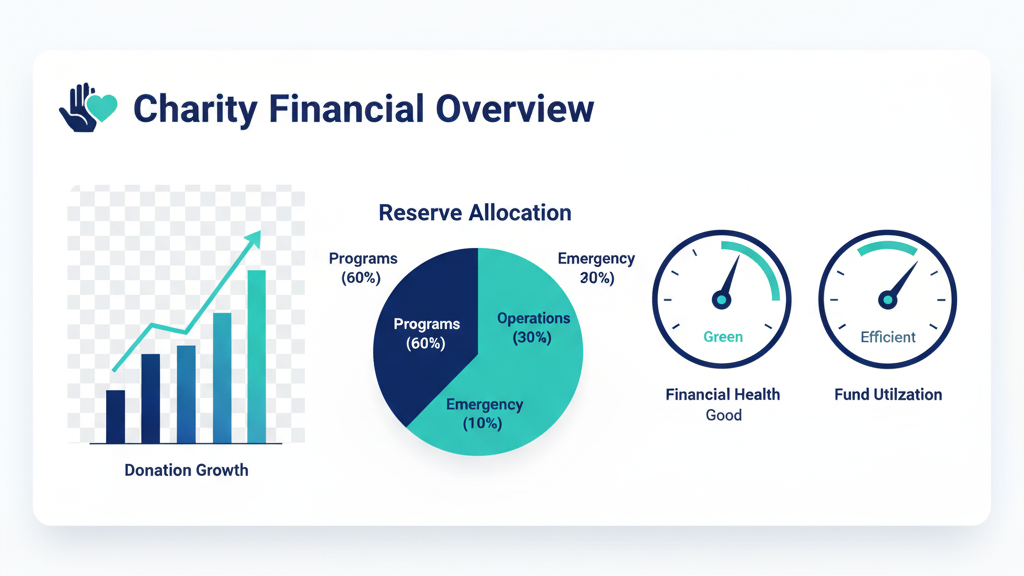

Why Do Reserves Matter So Much?

Having a healthy reserve isn’t about hoarding money; it’s about smart financial planning and ensuring your charity’s long-term survival. Reserves allow you to:

- Manage cash flow: Smooth out the lumpy nature of grants and donations.

- Cover unexpected costs: What if your office boiler breaks down? Reserves can save the day!

- Fund new opportunities: A brilliant new project idea might pop up that needs initial funding.

- Wind down responsibly: If the worst happens, reserves can cover closure costs, including staff redundancies.

A common misconception is that having reserves makes a charity look bad to donors. In our experience working with UK charities, the opposite is often true. A well-thought-out reserve policy shows that your organisation is well-managed, responsible, and built to last.

The Legal and Regulatory Framework

You’re not alone in figuring this out! The Charity Commission for England and Wales provides clear guidance on reserves. They don’t set a specific amount you must hold, but they do expect trustees to have a policy and to be able to justify it.

Key Requirements

- Charity Commission Guidance: The Commission’s guidance (CC19) states that trustees should regularly review their charity’s need for reserves and develop a policy that explains their decisions.

- SORP Requirements: The Statement of Recommended Practice (SORP) requires charities to disclose their reserve policy in their annual report and accounts. You need to explain the level of reserves held and why it’s appropriate for your organisation.

- Trustee Responsibilities: As a trustee, it’s your legal duty to protect your charity’s assets and ensure it is sustainable. This absolutely includes managing its reserves.

Your annual report is your chance to tell your charity’s financial story. A clear explanation of your reserve policy helps build trust with donors, funders, and the public.

Calculating the Right Reserve Level

So, what’s the magic number? I’m sorry to say there isn’t one! The right level of reserves is different for every charity. It depends on your unique circumstances.

Factors to Consider

- Your Income Streams: Is your income stable and predictable, or does it fluctuate wildly? Charities relying on a few large grants might need larger reserves than those with lots of regular, small donations.

- Your Expenditure: What are your fixed costs? Think about salaries, rent, and other essential overheads. When planning your budget, considering costs like charity payroll services UK is crucial for accuracy.

- Your Risks: What are the biggest financial risks your charity faces? A sudden loss of funding? An unexpected legal challenge?

Methods for Calculation

Two popular methods for calculating a target reserve level are:

- Months of Expenditure: This is a simple approach where you decide to hold enough money to cover a certain number of months’ essential running costs. A common benchmark is 3 to 6 months, but this might not be right for everyone.

- Risk-Based Approach: This is a more sophisticated method. You identify the key risks to your charity, estimate the financial impact of each, and consider the likelihood of them happening. This gives you a more tailored and justifiable reserve target.

For example, a small community centre with stable rental income might only need 3 months of reserves. In contrast, an international aid charity responding to emergencies might need 9-12 months of reserves to remain agile.

Creating Your Reserve Policy

Ready to put pen to paper? Creating a written reserve policy is a must-do for every charity. It doesn’t have to be a massive document, but it should be clear and concise.

A Step-by-Step Guide

- Discuss and Agree: Get all the trustees together to discuss why you need reserves and what you want the policy to achieve. Getting their buy-in from the start is essential!

- Analyse Your Finances: Use one of the methods above to calculate a target reserve level. Document your workings and assumptions.

- Draft the Policy: Write it all down! Your policy should include:

- The purpose of the policy.

- The target reserve level (and how you calculated it).

- The current level of reserves held.

- Steps you’ll take if reserves are too high or too low.

- When the policy will be reviewed.

- Approve and Adopt: The full board of trustees must formally approve the policy.

- Review Regularly: This isn’t a “set it and forget it” document. Best practice suggests reviewing your reserve policy at least once a year, or whenever there’s a significant change in your charity’s circumstances.

Managing and Building Reserves

Developing the policy is one thing; managing your reserves is an ongoing task. What do you do if your reserves are too low, or even too high?

Strategies for Building Reserves

If your reserves are below your target, don’t panic! You can develop a plan to build them up over time. This might involve:

- Budgeting for a small surplus each year.

- Launching a specific fundraising appeal for your reserve fund.

- Exploring unrestricted funding opportunities.

It’s all about balancing your immediate mission delivery with long-term financial health. You can’t help your beneficiaries tomorrow if your charity doesn’t exist.

When communicating with donors, be open and honest. Explain that your reserve fund ensures their donations have a lasting impact because your organisation is stable and secure.

If your reserves are consistently above your target, that’s a great problem to have! It’s an opportunity for trustees to think about investing more in your charitable activities. Could you launch a new service or expand an existing one?

If you’re unsure how to manage your charity’s funds or need support developing a compliant reserve policy, professional charity accounting services can provide tailored guidance.

Time to Review Your Policy

Wow, we’ve covered a lot! From understanding what reserves are to creating a robust policy, you’re now equipped with the knowledge to bolster your charity’s financial resilience. Remember, a reserve policy isn’t just a regulatory checkbox; it’s a vital tool for good governance and strategic planning. It empowers you to navigate uncertainty with confidence.

Your next step? Take this guide to your next trustee meeting. Start a conversation about your current reserve policy, or if you don’t have one, make a plan to create one. Professional support from expert charity accounting services can be invaluable in this process, ensuring your policy is not only compliant but perfectly suited to your mission. A financially resilient charity is a charity that can continue making a difference for years to come.